Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 53129Remission of tax 129.

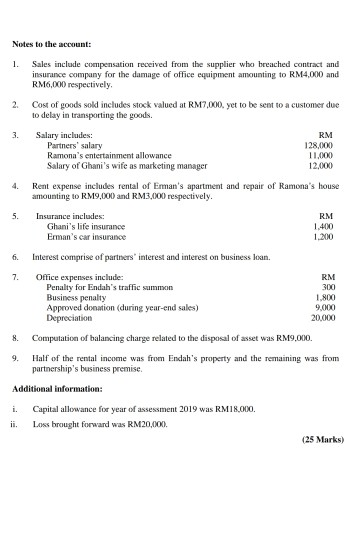

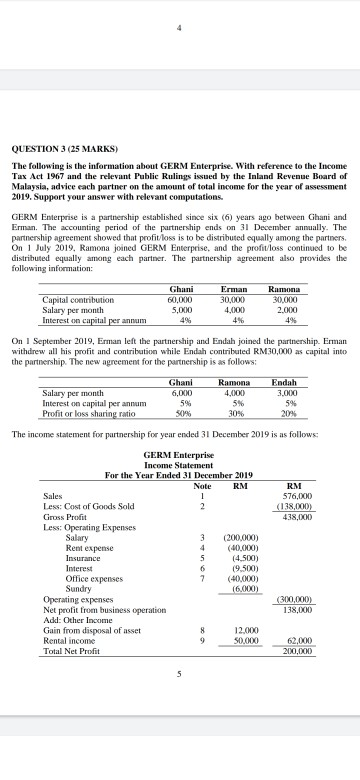

Question 3 25 Marks The Following Is The Chegg Com

28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and by the authority of the.

. The special classes of income are those listed in. Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith.

The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia. LAWS OF MALAYSIA Act 543 PETROLEUM INCOME TAX ACT 1967 An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith. Federal Legislation Portal Malaysia or Income Tax Act 1967 Copy.

Business planing and co-ordination. Procurement of raw materials components and finished products. 28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan.

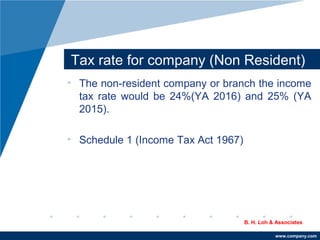

Income that a non-resident derives from Malaysia from special classes of income is subject to tax in Malaysia. A business entity in Malaysia is subject to the Income Tax Act 1967 ITA 1967 to pay taxes for any income generated through its operations. Back to top Public rulings and advance rulings To facilitate compliance with the law the DGIR is empowered to issue public rulings and advance rulings.

Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a student text. B subject to subsection 12 by deducting from that aggregate the amount of--. This volume contains the full text of the Income Tax Act 1967.

The phrase accruing in or derive from Malaysia means the source of income must be in Malaysia. Pursuant to section 2 of the ITA 1967 most business entities are generally taxable given the wide definition of a taxable person. Finance Act 2018 had introduced a new Section 140C to the Income Tax Act 1967 ITA to restrict the deductibility of interest expenses incurred by a person in respect of his business income in certain circumstances.

V the amount of his reserve fund for unexpired risks relating to any such Malaysian general certificate at the end of the immediately preceding basis period. 1 This Act may be cited as the Income Tax Act 1967. INCOME TAX ACT 1967 ACT 53 SCHEDULE 6 - Exemptions From Tax PART I INCOME WHICH IS EXEMPT 1.

Withholding tax is applicable on payments for certain types of income derived by non-residents. The prevailing WHT rate is 10 except where a lower rate is provided in an applicable tax treaty. Affected business modelsin-scope activities.

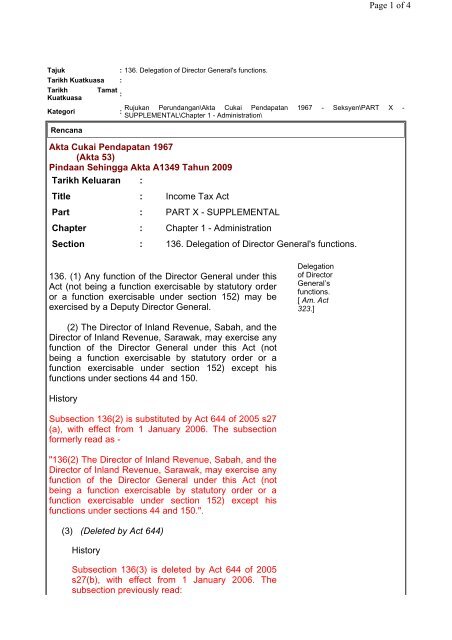

Finance Law Share this article a any deductions made under section 34 pursuant to this Schedule in respect of that expenditure from the gross income of the operator from the relevant business for the basis period for any year of assessment being a basis period ending before that date. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 5363DIncome of a unit trust from the letting of. Currently the ITA 1967 contains 13 Parts with 13 Schedules and 156 Sections.

The Income Tax Act 1967 Akta Cukai Pendapatan 1967 is a Malaysian laws which enacted for the imposition of income taxwikipedia 10 Related Articles filter. Income tax rules and legislative notifications have been reproduced or summarised in an easy-to-read table format. A 4162009 Income Tax Deduction for Investment in an Approved Consolidation of Management of Smallholding and Idle Land Project Rules 2009 - PU.

Income Tax Act 1967- Part 4. In addition to the complete text of the Income Tax. You can order records in advance to be ready for you when you visit Kew.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. I claims incurred in that period in connection with. General management and administration.

The official emoluments of a Ruler or Ruling Chief as defined in section 76. Introduction The Income Tax Act 1967 ITA 1967 is the main source of reference governing the income tax system in Malaysia. Rules and legislative notifi cations relating to income tax have also been reproduced or.

Income Tax Deduction for Promotion of Malaysia International Islamic Financial Centre Rules 2009 - PU. Catalogue description Malaysian Income Tax Act 1967 and Malaysian Income Tax Amendment Act 1967 Ordering and viewing options This record has not been digitised and cannot be downloaded. Income Tax Act 1967- Part 7 in Statute.

Remission of tax 1 The tax paid or payable by any person may be remitted wholly or in part-- a on grounds of poverty by the Director General. Offences under the Income Tax Act 1967 and the penalties thereof include the following. The ITA 1967 was first enacted in 1967 and frequently amended to accommodate the rapid development in Malaysian taxation.

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1. Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and reliable as a student text.

The official emoluments of the Consort of a Ruler of a State having the title of Raja Perempuan Sultanah Tengku Ampuan Raja Permaisuri Tengku Permaisuri or Permaisuri. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. - In addition WHT is also applicable to any payments for special classes of income which includes technical and non-technical services under the Income Tax Act 1967.

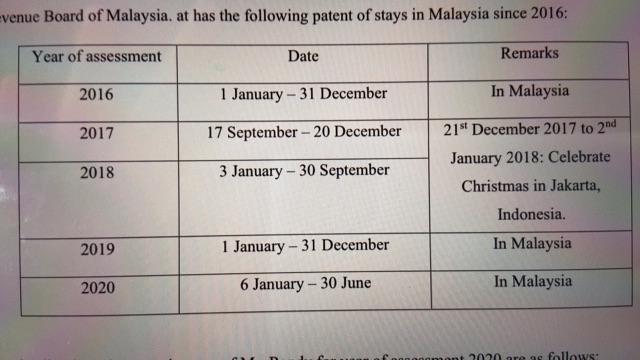

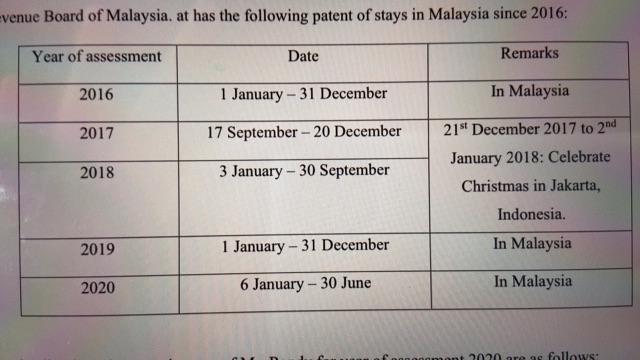

Solved Discuss The Resident Status Under Section 7 Of Income Chegg Com

Top Quality Payroll And Tax Services In Belgium Tax Services Payroll Financial

Tutorial 1 Resident Status Q 1 Acc60704 Malaysian Taxation Tutorial 1 Resident Status Question 1 Studocu

Financing And Leases Tax Treatment Acca Global

Buy Income Tax Act Online Lazada Com My

Financing And Leases Tax Treatment Acca Global

60f Investment Holding Company

Question 3 25 Marks The Following Is The Chegg Com

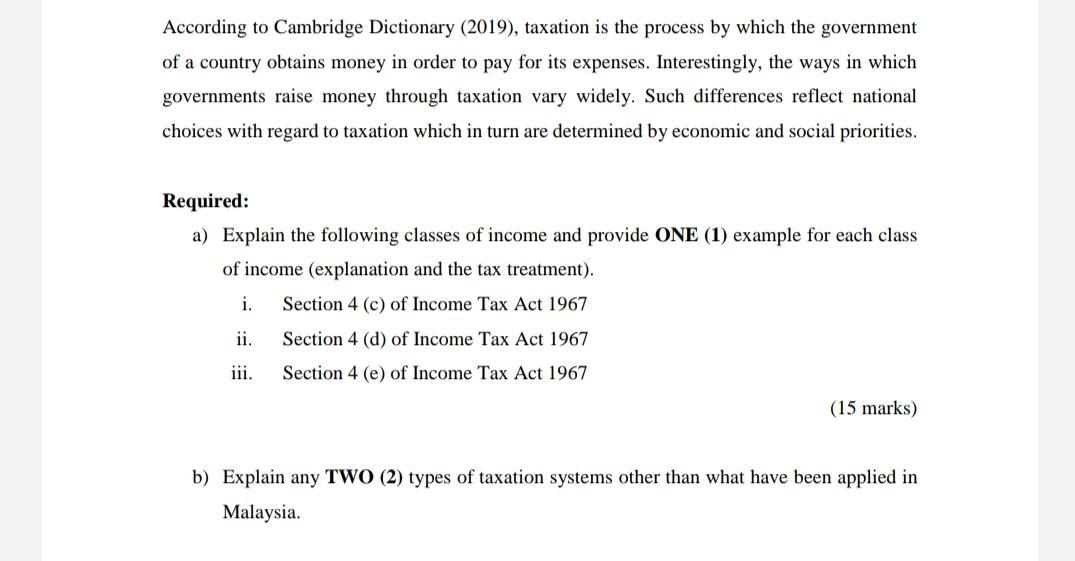

Solved According To Cambridge Dictionary 2019 Taxation Is Chegg Com

How Much Does It Cost To Develop A Law Firm Mobile App Development

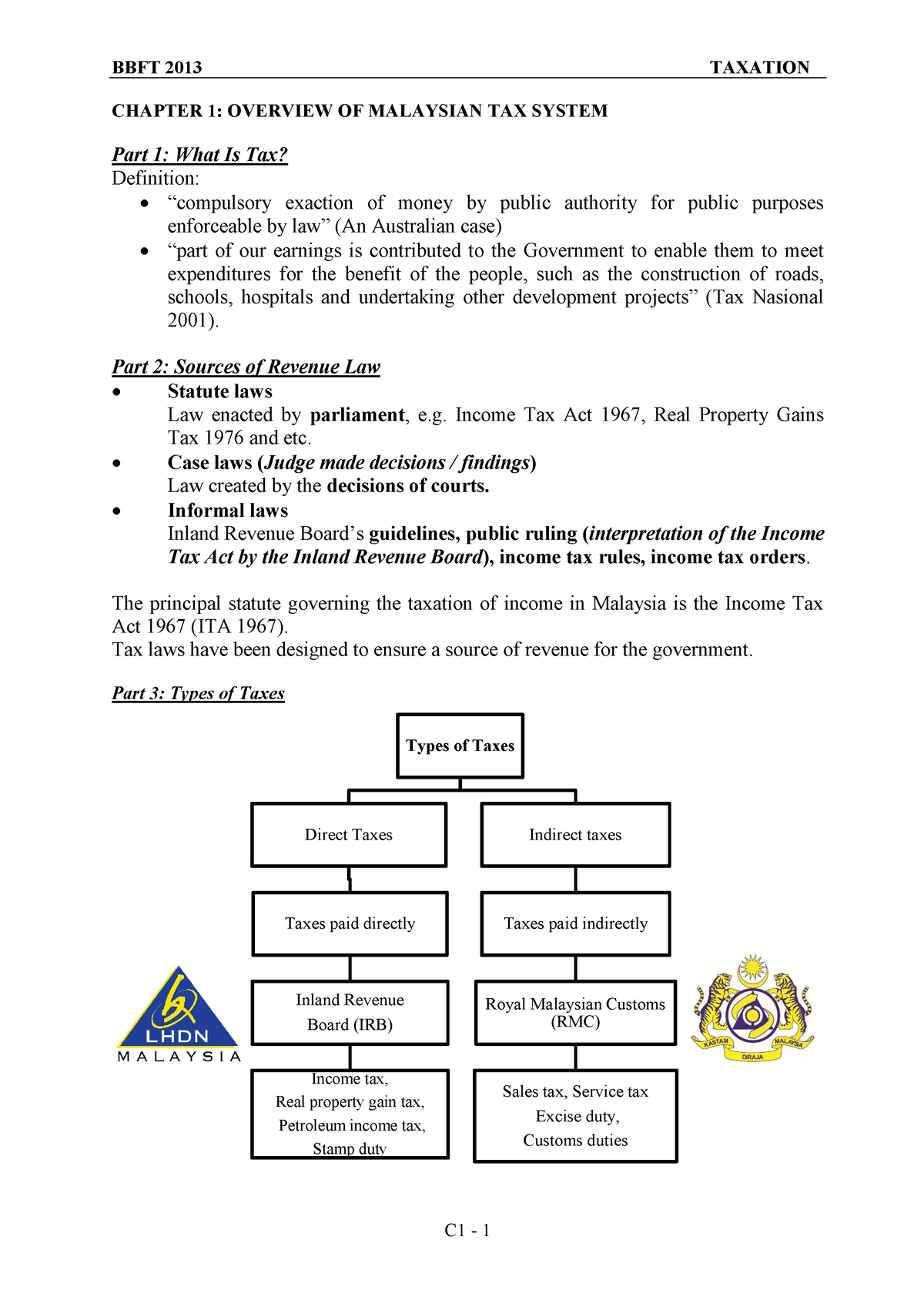

Chapter 1 Overview Of Malaysian Tax System Chapter 1 Overview Of Malaysian Tax System Part 1 Studocu

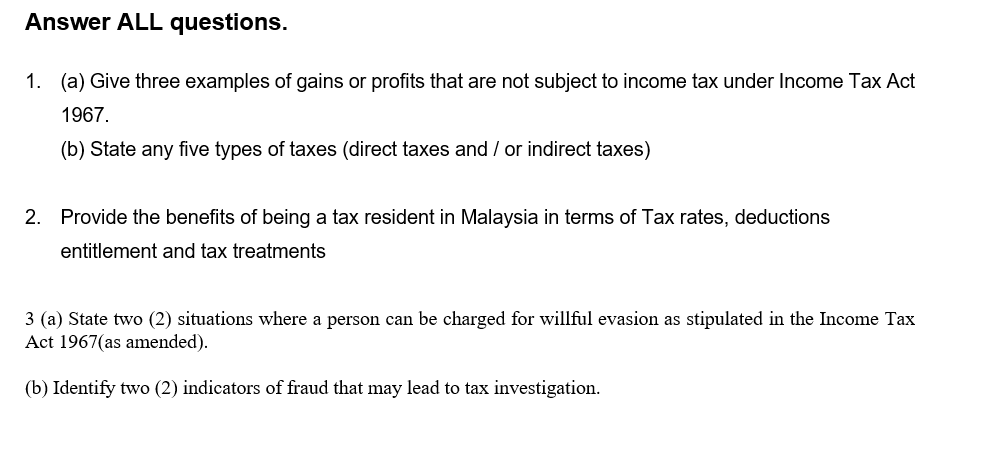

Solved Answer All Questions 1 A Give Three Examples Of Chegg Com

Solved Answer All Questions 1 A Give Three Examples Of Chegg Com

Akta Cukai Pendapatan 1967 Akta 53 Pindaan Sehingga Akta

Solved Answer All Questions 1 A Give Three Examples Of Chegg Com

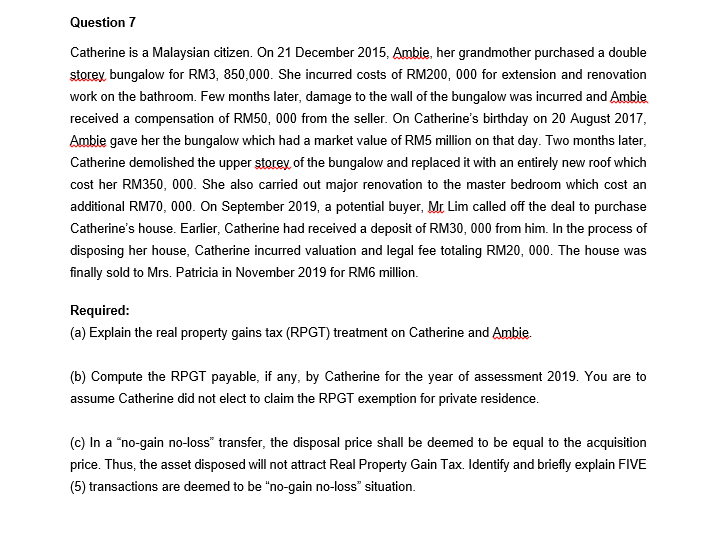

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia